☑

☒ Preliminary Proxy Statement

☐ Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

☐ Definitive Proxy Statement

☐ Definitive Additional Materials

☐ Soliciting Material Pursuant to § 240.14a-12

VAXART, INC. | ||

|

| |

|

| |

|

| |

|

|

Biota Pharmaceuticals, Inc.

(Name of Registrant as Specified In Its Charter) |

(Name of Person(s) Filing Proxy Statement if |

Payment of Filing Fee (Check the appropriate box):

|

☒ No fee required. ☐ Fee paid previously with preliminary materials ☐ Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

BIOTA PHARMACEUTICALS,VAXART, INC.

2500 Northwinds Parkway,170 Harbor Way, Suite 100300

Alpharetta, GA 30009South San Francisco, California 94080

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

November 12, 2013

To Be Held on Tuesday, June 7, 2022

NOTICE IS HEREBY GIVEN thatDear Stockholder:

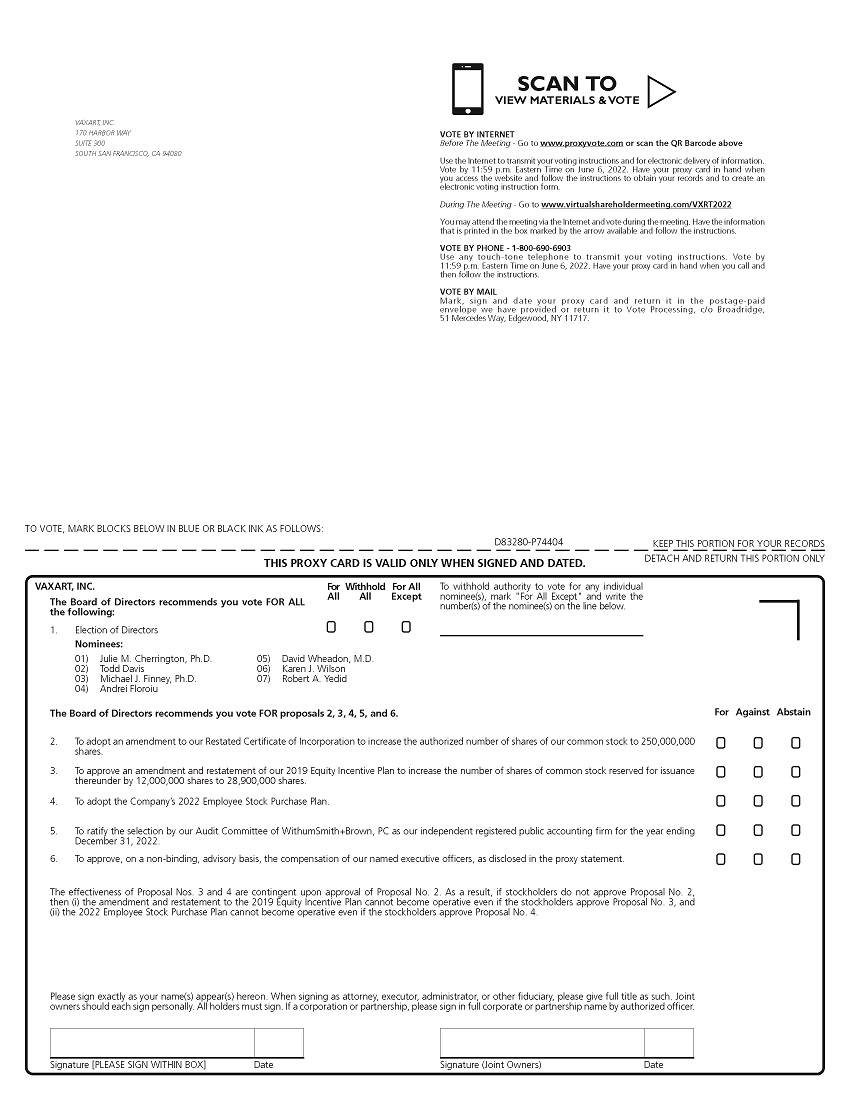

You are cordially invited to attend the 20132022 Annual Meeting of Stockholders of Biota Pharmaceuticals,Vaxart, Inc. (the “Company”), a Delaware corporation. The meeting will be held on Tuesday, June 7, 2022, at 9:0030 a.m., Eastern Time, on November 12, 2013 local time at the corporate offices of the CompanyVaxart, Inc. located at 2500 Northwinds Parkway,170 Harbor Way, Suite 100, Alpharetta, GA 30009300, South San Francisco, California 94080, and through live webcast of the meeting, which you can access, together with the list of stockholders entitled to vote at the meeting during the meeting, by visiting www.virtualshareholdermeeting.com/VXRT2022 and entering the 16‐digit control number included in your Notice of Internet Availability of Proxy Materials, on your proxy card or in the instructions that accompanied your proxy materials for the following purposes:

1.1. To elect the board of directors’ seven directors of the Companynominees for director to hold officeserve until the 2014 Annual Meetingnext annual meeting of Stockholdersstockholders and until the electiontheir successors are duly elected and qualification of their respective successors;qualified.

2. To ratify the selection of PricewaterhouseCoopers LLP as the independent registered public accounting firm of the Company for its fiscal year ending June 30, 2014;

3. To approveadopt an amendment to the Company’sour Restated Certificate of Incorporation as amended, to decreaseincrease the authorized number of the authorized shares of the Company’sour common stock from 200,000,000 to 70,000,000;250,000,000 shares.

4.3. To approve, thecontingent upon approval of Proposal No. 2, an amendment to the Company’s 2007 Omnibusand restatement of our 2019 Equity and Incentive Plan to increase the number of shares of common stock reserved under the planfor issuance thereunder by 3,000,00012,000,000 shares to 28,900,000 shares.

4. To adopt, contingent upon approval of Proposal No. 2, the Company’s common stock,to revise certain limitations on the awards intended to qualify as performance-based awards for purposes of Section 162(m) of the Internal Revenue Code of 1986, as amended, and to re-approve the performance goals for performance based awards;2022 Employee Stock Purchase Plan.

5. To ratify the selection by our Audit Committee of WithumSmith+Brown, PC as our independent registered public accounting firm for the year ending December 31, 2022.

6. To approve, byon a non-binding, advisory vote,basis, the compensation of the Company’sour named executive officers; andofficers, as disclosed in this proxy statement.

6.7. To transact suchconduct any other business as may properly comebrought before the meeting and any adjournment thereof.meeting.

We are actively monitoring the coronavirus (COVID-19) pandemic and we are sensitive to the public health and travel concerns our stockholders may have and the protocols that federal, state, and local governments may impose. In the event it is not possible or advisable to hold our Annual Meeting in person, we will announce alternative arrangements for the meeting as promptly as practicable, which may include postponing or adjourning the meeting or holding the meeting solely by means of remote communication (i.e., a virtual-only meeting). We plan to announce any such updates via a press release and posting details on our website that will also be filed with the SEC as proxy material. Please monitor the Investor Relations section of our website at www.vaxart.com for updated information. If you are planning to attend our Annual Meeting, please check the website one week prior to the Annual Meeting date. As always, we encourage you to vote your shares prior to the Annual Meeting.

These items of business are more fully described in the Proxy Statement accompanying this notice.

The record date for the Annual Meeting is April 11, 2022. Only holdersstockholders of record of the Company’s common stock at the close of business on September 19, 2013 are entitled to notice of, and tothat date may vote at the meeting andor any adjournment thereof. Such stockholders may vote in person or by proxy.

ALL STOCKHOLDERS ARE CORDIALLY INVITED TO ATTEND THE MEETING IN PERSON. HOWEVER, EVEN IF YOU PLAN TO ATTEND THE MEETING, PLEASE FOLLOW THE INSTRUCTIONS FOR INTERNET VOTING ON THE NOTICE OF AVAILABILITY OF PROXY MATERIALS, OR PLEASE COMPLETE, SIGN, DATE AND RETURN THE PROXY CARD SO THAT YOUR SHARES WILL BE VOTED AT THE MEETING. NO POSTAGE IS REQUIRED IF MAILED IN THE UNITED STATES.

By Order of the Board of Directors

Todd C. Davis

Chairman of the Board

Russell H. PlumbSouth San Francisco, California

President and Chief Executive Officer_________, 2022

BIOTA PHARMACEUTICALS, INC.

We are primarily providing access to our proxy materials over the internet pursuant to the Securities and Exchange Commission’s notice and access rules. On or about April 28, 2022, we expect to mail to our stockholders a Notice of Internet Availability of Proxy Materials that will indicate how to access our 2022 Proxy Statement and 2021 Annual Report on the internet and will include instructions on how you can receive a paper copy of the annual meeting materials, including the notice of annual meeting, proxy statement, and proxy card. |

Whether or not you expect to attend the meeting, please submit a proxy or voting instructions for your shares promptly using the directions on your Notice, or, if you elected to receive printed proxy materials by mail, your proxy card, by one of the following methods: (1) over the internet at http://www.proxyvote.com, (2) by telephone by calling the toll-free number (800) 690-6903, or (3) if you elected to receive printed proxy materials by mail, by marking, dating, and signing your proxy card and returning it in the accompanying postage-paid envelope. Even if you have voted by proxy, you may still vote in person if you attend the meeting. Please note, however, that if your shares are held of record by a broker, bank, or other nominee and you wish to vote at the meeting, you must obtain a proxy issued in your name from that record holder. |

2500 Northwinds Parkway, Suite 100

Alpharetta, GA 30009

TABLE OF CONTENTS

SECTION | Page | |

QUESTIONS AND ANSWERS ABOUT THESE PROXY MATERIALS AND VOTING | 2 |

PROXY STATEMENT

| 9 |

| 10 |

Information Regarding the Board of Directors and Corporate Governance | 12 | ||

| 13 | |||

| 18 | |||

| 18 | |||

| 19 | |||

| 19 | |||

| 19 |

| 20 |

| 22 |

| 32 |

| 35 |

PROPOSAL NO. 5 RATIFICATION OF SELECTION OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM | 36 |

| 37 |

| 38 |

| 38 |

| 44 |

| 49 |

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT | 51 |

| 52 |

| 53 |

| 54 |

| 54 |

This Proxy StatementEXHIBITS

Exhibit A: Certificate of Amendment to Certificate of Incorporation | A-1 | ||

| B-1 | |||

| C-1 |

VAXART, INC.

170 Harbor Way, Suite 300

South San Francisco, California 94080

PROXY STATEMENT

FOR THE 2022 ANNUAL MEETING OF STOCKHOLDERS

June 7, 2022

QUESTIONS AND ANSWERS ABOUT THESE PROXY MATERIALS AND VOTING

Who is furnishedVaxart?

We are a clinical-stage biotechnology company primarily focused on the development of oral recombinant vaccines based on our Vector-Adjuvant-Antigen Standardized Technology (“VAAST”) proprietary oral vaccine platform. Our oral vaccines are designed to generate broad and durable immune responses that may protect against a wide range of infectious diseases and may be useful for the treatment of chronic viral infections and cancer. Our investigational vaccines are administered using a room temperature-stable tablet, rather than by injection.

We are developing prophylactic vaccine candidates that target a range of infectious diseases, including SARS-CoV-2 (the virus that causes coronavirus disease 2019 (“COVID-19”)), norovirus (a widespread cause of acute gastro-intestinal enteritis), seasonal influenza and respiratory syncytial virus (“RSV”) (common causes of respiratory tract infections). We have completed a Phase 1 clinical trial for our first SARS CoV-2 vaccine candidate, that commenced in connectionOctober 2020; the study met its primary and secondary endpoints. A Phase 2 study with our second-generation SARS CoV-2 vaccine candidate commenced dosing in October 2021 and is currently ongoing. Three Phase 1 human studies for our norovirus vaccine candidate have been completed, including a study with a bivalent norovirus vaccine which, as we disclosed in September 2019, met its primary and secondary endpoints. Additional Phase 1 studies with our norovirus vaccine are currently ongoing. In addition, we have started a Phase 2 monovalent norovirus GI.1 challenge study. Our monovalent H1 influenza vaccine protected participants against H1 influenza infection in a Phase 2 challenge study, as published in 2020 (Lancet ID). In addition, we are in early development of our first therapeutic vaccine targeting cervical cancer and dysplasia caused by human papillomavirus (“HPV”).

Vaccines have been essential in eradicating or significantly reducing multiple devastating infectious diseases, including polio, smallpox, mumps, measles, diphtheria, hepatitis B, influenza, HPV and several others. According to a MarketsandMarkets research report titled “Vaccines Market - Global Forecast to 2023”, the solicitationglobal market for vaccines is expected to reach $50.42 billion by 2023 from $36.45 billion in 2018, at a compound annual growth rate of 6.7%.

We believe our oral tablet vaccine candidates offer several important advantages, the most notable being:

First, they are designed to generate broad and durable immune responses, including systemic, mucosal and T cell responses, which may enhance protection against certain infectious diseases, such as COVID-19, influenza, norovirus and RSV, and may have potential clinical benefit for certain cancers and chronic viral infections, such as those caused by HPV.

Second, our tablet vaccine candidates are designed to provide a more efficient and convenient method of administration, enhance patient acceptance and reduce distribution bottlenecks, which we believe will improve the effectiveness of vaccination campaigns. For example, according to the U.S. Centers for Disease Control and Prevention (the “CDC”), in the 2018/2019 seasonal influenza season, only approximately 49% of the U.S. population was vaccinated against influenza, with particularly low vaccination rates among adults between ages 18 and 49.

In 2021, we began active engagement efforts to ensure stockholder interests were incorporated into our planning practice for environmental, social, and governance (“ESG”) initiatives. During 2021, we discussed various topics (including diversity and inclusion of our workforce, our ESG initiatives, and our executive compensation philosophy) with stockholders. In part as a result of stockholder feedback, we continue to enhance our disclosures and ESG reporting practices, and we continue to encourage you to share your opinions with us. Vaxart has embedded ESG considerations in our governance structures (including in the charters of the committees of our board of directors), strategies, risk management, and reporting. Board of Directors (the “Board” or the “Boarddirectors oversight of Directors”) of Biota Pharmaceuticals, Inc. (“Biota” or the “Company”) of proxies to be voted at the 2013 Annual Meeting of Stockholders to be held on November 12, 2013 (the “Annual Meeting”). The purposes of the Annual Meeting are as follows:

1. To elect seven directors of the Company to hold office until the 2014 Annual Meeting of StockholdersESG matters is integrated into our governance structures, including Nominating and until the electionGovernance Committee responsibility in assisting in overseeing and qualification of their respective successors;

2. To ratify the selection of PricewaterhouseCoopers LLP as the independent registered public accounting firm of the Company for its fiscal year ending June 30, 2014; and

3. To approve an amendment tomonitoring the Company’s Restated Certificate of Incorporation, as amended,approach and strategy relating to decreaseenvironmental, legal and social responsibility, diversity, and other corporate citizenship and sustainability matters; Audit Committee responsibility for reviewing with management the number of the authorized sharestype and presentation of the Company’s common stock from 200,000,000ESG disclosures and the adequacy and effectiveness of applicable internal controls related to 70,000,000;

4. To approvesuch disclosures; Compensation Committee responsibility for reviewing and advising management on our strategies and policies related to talent management (including talent acquisition, development and retention, internal pay equity, diversity and inclusion and corporate culture); and Science and Technology Committee responsibility in assisting the amendment to the Company’s 2007 Omnibus Equity and Incentive Plan to increase the numberboard of shares reserved under the plan by 3,000,000 sharesdirectors in its oversight of the Company’s common stock,to revise certain limitations onresearch and development programs. Vaxart’s management, in consultation and with the awards intended to qualify as performance-based awards for purposes of Section 162(m)oversight and direction of the Internal Revenue Code of 1986, as amended,Nominating and Governance Committee, actively works to re-approveidentify priority ESG issues for Vaxart, is developing an ESG program, is forming an internal, management-level ESG governance structure, and provides progress reports to the performance goals for performance based awards;

5. To approve, by a non-binding advisory vote, the compensation of the Company’s named executive officers;

6. To transact such other business as may properly come before the Annual MeetingNominating and any adjournment thereof.

The Notice of Annual Meeting of Stockholders, this Proxy Statement, the proxy card and the 2013 Annual Report to Stockholders are being made available to stockholders beginning on or about October 1, 2013.

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE

2013 ANNUAL MEETING OF STOCKHOLDERS TO BE HELD ON NOVEMBER 12, 2013

This proxy statement and the 2013 Annual Report are available at http://investors.biotapharma.comGovernance Committee.

GENERAL INFORMATION ABOUT THE ANNUAL MEETING AND VOTINGVaxart Biosciences, Inc. was originally incorporated in California under the name West Coast Biologicals, Inc. in March 2004 and changed its name to Vaxart, Inc. (“Private Vaxart”) in July 2007, when it reincorporated in the state of Delaware.

Why are you receiving theseOn February 13, 2018, Private Vaxart completed a reverse merger (the “Merger”) with Aviragen Therapeutics, Inc. (“Aviragen”), pursuant to which Private Vaxart survived as a wholly owned subsidiary of Aviragen. Under the terms of the Merger, Aviragen changed its name to Vaxart, Inc. and Private Vaxart changed its name to Vaxart Biosciences, Inc. Unless otherwise indicated, all references to “Vaxart,” “we,” “us,” “our” or the “Company” in this proxy materials?statement mean Vaxart, Inc., the combined company.

The Company is providing these proxy materials to you because the Board of Directors is soliciting holders of the Company’s common stock, $0.10 par value per share (the “Common Stock”), to provide proxies to be voted at the Annual Meeting. The Annual Meeting is scheduled for November 12, 2013, commencing at 9:00 a.m. local time at the Company’s corporate offices located at 2500 Northwinds Parkway, Suite 100, Alpharetta, GA 30009. Your proxy will be used at the Annual Meeting or at any adjournment(s) of the meeting.

Why did Ireceive a notice of internetregarding the availability of proxy materials instead of a full set of proxy materials?on the Internet?

In accordance with thePursuant to rules ofadopted by the U.S. Securities and Exchange Commission (“SEC”(the “SEC”), the Company is permittedwe have elected to furnishprovide access to our proxy materials including this proxy statement and its 2013 annual report, to stockholders by providing access to these documents onover the internet insteadInternet. Accordingly, we have sent you a Notice of mailing printed copies. Most stockholders will not receive printed copiesInternet Availability of Proxy Materials (“Notice”), because the proxy materials unless requested. Instead, the notice provides instructions on how to access and review the proxy materials on the internet. The notice also provides instructions on how to submit your proxy and voting instructions via the internet. If you would like to receive a printed or email copyboard of the Company’s proxy materials, please follow the instructions for requesting the materials in the notice.

Who is soliciting my proxy?

The Boarddirectors of Vaxart, Inc. is soliciting your proxy to vote on all matters scheduled to come beforeat the Company’s2022 Annual Meeting whetherof Stockholders (the “Annual Meeting”), including at any adjournment or not you attend in person. By completing, dating, signing and returningpostponement of the meeting. All stockholders will have the ability to access the proxy cardmaterials on the website referred to in your Notice or voting instruction card, or by submitting yourrequest to receive a printed set of the proxy and voting instructions viamaterials. Instructions on how to access the proxy materials over the internet you are authorizing the proxy holdersor to voterequest a printed copy may be found in your shares at the annual meeting as you have instructed.Notice.

Who isWe intend to mail the Notice of Internet Availability of Proxy Materials on or about April 28, 2022, to all stockholders of record entitled to vote at the Annual Meeting?Meeting.

StockholdersWill I receive any other proxy materials by mail?

No, you will not receive any other proxy materials by mail unless you request a paper copy of proxy materials. To request that a full set of the proxy materials be sent to your specified postal address, please go to www.proxyvote.com, or call (800) 579-1639, or send an email to sendmaterials@proxyvote.com. Please have your proxy card in hand when you access the website or call and follow the instructions provided therein.

How do I attend the Annual Meeting?

The meeting will be held on Tuesday, June 7, 2022, at 9:30 a.m. local time at the offices of Vaxart located at 170 Harbor Way, Suite 300, South San Francisco, California 94080. Directions to the Annual Meeting may be found on the Investors section of our website at www.vaxart.com. Information on how to vote in person at the Annual Meeting is discussed below. You will also be able to listen and participate in the Annual Meeting as well as vote and submit your questions during a live webcast of the meeting by visiting www.virtualshareholdermeeting.com/VXRT2022 and entering the 16‐digit control number included in your Notice, on your proxy card or in the instructions that accompanied your proxy materials. As part of our precautions regarding COVID-19, we are planning for the possibility that the meeting may be held virtually only over the Internet. If we take this step, we will announce the decision to do so via a press release and posting details on our website that will also be filed with the SEC as proxy material. As always, we encourage you to vote your shares prior to the Annual Meeting.

Who can vote at the Annual Meeting?

Only stockholders of record at the close of business on September 19, 2013, the record date for the Annual Meeting (the “Record Date”), areApril 11, 2022, will be entitled to receive notice of the Annual Meeting and to vote their shares held on that date. As of the Record Date, 28,423,987 shares of Common Stock were outstanding, each of which is entitled to one vote on each proposal to be considered at the Annual Meeting. Stockholders do not have cumulative voting rights.On this record date, there were 126,405,811 shares of common stock outstanding and entitled to vote.

How can you vote?Stockholder of Record:Shares Registered in Your Name

If on April 11, 2022, your shares were registered directly in your name with our transfer agent, American Stock Transfer & Trust Company, LLC, then you are a stockholder of record. As a stockholder of record, you may vote in person at the meeting, vote by proxy, or vote by visiting www.virtualshareholdermeeting.com/VXRT2022 and entering the 16���digit control number included in your Notice. Whether or not you plan to attend the meeting, we urge you to submit a proxy to ensure your vote is counted.

StockholdersBeneficial Owner: Shares Registered in the Name of a Broker or Bank

If on April 11, 2022, your shares were held, not in your name, but rather in an account at a brokerage firm, bank, dealer or other similar organization, then you are the beneficial owner of shares held in “street name” and your Notice is being forwarded to you by that organization. The organization holding your account is considered to be the stockholder of record for purposes of voting at the Annual Meeting. As a beneficial owner, you have the right to direct your broker or other agent regarding how to vote the shares in your account. You are also invited to attend the Annual Meeting or vote by visiting www.virtualshareholdermeeting.com/VXRT2022 and entering the 16‐digit control number included in your Notice. However, since you are not the stockholder of record, you may not vote your shares in person at the meeting unless you request and obtain a valid proxy from your broker or other agent.

What am I voting on?

There are six matters scheduled for a vote:

● | Proposal No. 1 – To elect seven directors to hold office until the next annual meeting of stockholders and until their successors are duly elected and qualified. |

● | Proposal No. 2 – To adopt an amendment to our Restated Certificate of Incorporation to increase the authorized number of shares of our common stock to 250,000,000 shares. |

● | Proposal No. 3 – To approve, contingent upon approval of Proposal No. 2, an amendment and restatement of our 2019 Equity Incentive Plan to increase the number of shares of common stock reserved for issuance thereunder by 12,000,000 shares to 28,900,000 shares. |

● | Proposal No. 4 – To adopt, contingent upon approval of Proposal No. 2, the Company’s 2022 Employee Stock Purchase Plan. |

● | Proposal No. 5 – To ratify the selection by our Audit Committee of WithumSmith+Brown, PC as our independent registered public accounting firm for the year ending December 31, 2022. |

● | Proposal No. 6 – To approve, on a non-binding, advisory basis, the compensation of our named executive officers, as disclosed in this proxy statement. |

What if another matter is properly brought before the meeting?

The board of directors knows of no other matters that will be presented for consideration at the Annual Meeting. If any other matters are properly brought before the meeting, it is the intention of the persons named in the accompanying proxy to vote on those matters in accordance with their best judgment.

How do I vote?

You may either vote “For” the nominees to the board of directors or you may “Withhold” your vote for any nominee you specify. For all other proposals you may vote “For” or “Against” or abstain from voting.

The procedures for voting are fairly simple:

Stockholder of Record: Shares Registered in Your Name

If you are a stockholder of record, holder, which means your shares are registered in your name, you may vote in person at the Annual Meeting, vote by proxy at the meeting, vote by proxy through the internet by visiting www.virtualshareholdermeeting.com/VXRT2022 and entering the 16‐digit control number included in your Notice, or submit a proxy: proxy to vote your shares in advance of the meeting by using a proxy card that you may request or that we may elect to deliver at a later time or by telephone or the internet. Whether or not you plan to attend the meeting, we urge you to vote by proxy to ensure your vote is counted. You may still attend the meeting and vote in person even if you have already voted by proxy.

● | To vote in person, come to the Annual Meeting, provide us with your identification, and we will give you a ballot when you arrive. |

1. Over the Internet — If you have internet access, you may authorize the voting of your shares by following the internet voting instructions set forth in the notice of internet availability of proxy materials. You must specify how you want your shares voted, or your vote will not be registered and you will receive an error message. Your shares will be voted according to your instructions.

● | To submit a proxy card, simply complete, sign and date the proxy card that may be delivered and return it promptly in the envelope provided. If you return your signed proxy card to us before the Annual Meeting, the proxyholders named therein will vote your shares as you direct. |

● | To submit a proxy over the telephone, dial toll-free (800) 690-6903 using a touch-tone phone and follow the recorded instructions. You will be asked to provide the company number and control number from your Notice. Your telephone vote should be received by 11:59 p.m., Eastern Time on June 6, 2022 in order to ensure that it is counted. |

● | To submit a proxy through the internet, go to http://www.proxyvote.com to complete an electronic proxy card. You will be asked to provide the company number and control number from your Notice. Your proxy submitted by internet should be received by 11:59 p.m., Eastern Time on June 6, 2022 in order to ensure that it is counted. |

2. By Mail — If you have received printed materials, complete, date and sign your proxy card and return it in the postage-paid envelope provided. If you sign your proxy card but do not specify how you want your shares voted, they will be voted in accordance with the recommendations of the Board. Unsigned proxy cards will not be voted.

3. In Person at the Meeting — If you attend the Annual Meeting, you may deliver a completed and signed proxy card in person or you may vote by completing a ballot, which the Company will provide to you at the Annual Meeting.

Beneficial Owners: Owner:Shares Registered in the Name of Broker or Bank

If you are a beneficial owner of shares registered in the name of your broker, bank, or other agent, (typically referred to as being held in “street name”), you should receivehave received a noticeNotice containing voting instructions from that organization rather than the Company.from Vaxart. Simply follow the voting instructions in the noticeyour Notice to ensure that your vote is counted. To vote in person or virtually at the Annual Meeting, you must obtain a valid proxy from your broker, bank, or other agent. Follow the instructions from your broker bank or agentbank included with these proxy materials, or contact your broker bank or agentbank to request a proxy form. You may also vote by visiting www.virtualshareholdermeeting.com/VXRT2022 and entering the 16‐digit control number included in your Notice.

What are “broker non-votes”?The ability to submit a proxy via the internet may be provided to allow you to submit a proxy to vote your shares online, with procedures designed to ensure the authenticity and correctness of your proxy vote instructions.However, please be aware that you must bear any costs associated with your internet access, such as usage charges from internet access providers and telephone companies.

How many votes do I have?

On each matter to be voted upon, you have one vote for each share of common stock you own as of April 11, 2022.

What happens if I do not vote?

Stockholder of Record: Shares Registered in Your Name

If you are a stockholder of record and do not submit a proxy by completing and delivering your proxy card or through the internet or telephone, and do not vote in person (or virtually) at the Annual Meeting, your shares will not be voted.

Beneficial Owner:Shares Registered in the Name of Broker non-votes occur whenor Bank

If you are a beneficial owner and do not instruct your broker, bank, or other agent how to vote your shares, the question of shares held in street name does not give instructions to thewhether your broker or nominee holding the shares as to howwill still be able to vote your shares depends on matters deemed “non-routine”. Generally, if shares are held in street name,whether the beneficial owner ofNew York Stock Exchange, or NYSE, deems the shares is entitledparticular proposal to give voting instructionsbe a “routine” matter. Brokers and nominees can use their discretion to the broker or nominee holding the shares. If the beneficial owner does not provide voting instructions, the broker or nominee can still vote the“uninstructed” shares with respect to matters that are considered to be “routine”, such as the ratification of the appointment of the independent registered public accounting firm for the Company; however,“routine,” but not with respect to “non-routine” matters. Under the rules and interpretations of NYSE, which apply regardless of whether an issuer is listed on the NYSE or Nasdaq, “non-routine” matters which would includeare matters that may substantially affect the rights or privileges of stockholders, including, but not limited to,such as mergers, stockholder proposals, relating to electionelections of directors (even if not contested), executive compensation (including any advisory stockholder votes on executive compensation and on the compensationfrequency of our namedstockholder votes on executive officers,compensation), and certain corporate governance proposals, even if management-supported. Accordingly, your broker or nominee may not vote your shares on Proposal No. 1, Proposal No. 3, Proposal No. 4 or Proposal No. 6 without your instructions, but may vote your shares on Proposal No. 2 and Proposal No. 5 even in the absence of your instruction.

What if I return a proxy card or otherwise vote but do not make specific choices?

If you return a signed and dated proxy card or otherwise vote without marking voting selections, your shares will be voted, as applicable:

● | “For” the election of the seven nominees for director; |

● | “For” the adoption of the amendment to our Restated Certificate of Incorporation to increase the authorized number of shares of our common stock to 250,000,000 shares; |

● | “For” the approval of the amendment to our 2019 Equity Incentive Plan to increase the number of shares of common stock reserved for issuance thereunder by 12,000,000 shares to 28,900,000 shares; |

● | “For” the adoption of the Company’s 2022 Employee Stock Purchase Plan; |

● | “For” the ratification of the selection of WithumSmith+Brown, PC as our independent registered public accounting firm for the year ending December 31, 2022; and |

● | “For” the non-binding, advisory approval of executive compensation. |

If any other matter is properly presented at the meeting, your proxyholder (one of the amendment to the Company’s Restated Certificate of Incorporation, the approval of the amendment to the 2007 Omnibus Equity and Incentive Plan and stockholder proposals, if any.individuals named on your proxy card) will vote your shares using his best judgment.

Can you change your vote or revoke your proxy?Who is paying for this proxy solicitation?

We will pay for the entire cost of soliciting proxies. In addition to these proxy materials, our directors and employees may also solicit proxies in person, or by other means of communication. Directors and employees will not be paid any additional compensation for soliciting proxies. We may also reimburse brokerage firms, banks, and other agents for the cost of forwarding proxy materials to beneficial owners. We have engaged Morrow Sodali to assist in the solicitation of proxies and provide related advice and informational support for a fee of $7,500 plus out-of-pocket expenses and customary disbursements.

What does it mean if I receive more than one Notice?

If you receive more than one Notice, your shares may be registered in more than one name or in different accounts. Please follow the voting instructions on your Notices to ensure that all of your shares are voted.

Can I change my vote after submitting my proxy?

Stockholder of Record: Shares Registered in Your Name

Yes. You may change your vote orcan revoke your proxy at any time before your shares are votedthe final vote at the Annual Meeting by: (1) notifying the Company’s Secretary, Peter Azzarello, in writing at 2500 Northwinds Parkway, Suite 100, Alpharetta, GA 30009, that you are revoking your proxy; (2) submitting new voting instructions using any of the methods described above; or (3) attending and voting by ballot at the Annual Meeting.

meeting. If you are the beneficial ownerrecord holder of your shares, held in street name, you must submit new voting instructions to your broker, bank, or other nominee pursuant to the instructions you have received from them.

How willmay revoke your proxy vote your shares?

Your proxy will vote according to your instructions. If you vote by mail and complete, sign, and return the proxy card but do not indicate your vote, your proxy will vote “FOR” eachin any one of the director nominees, “FOR” for the ratification of the appointment of PricewaterhouseCoopers LLP, “FOR” the approval of the amendment to the Company’s Restated Certificate of Incorporation, ”FOR” the approval of the amendment to the Company’s 2007 Omnibus Equity and Incentive Plan and the re-approval of performance goals for performance based awards and “FOR” the approval, by a non-binding advisory vote, of the compensation of the Company’s named executive officers, which votes represent the recommendations of the Board with respect to such matters. The Board does not intend to bring any other matter for a vote at the Annual Meeting, and neither the Company nor the Board knows of anyone else who intends to do so. However, on any other business that properly comes before the Annual Meeting, your proxies are authorized to vote on your behalf using their best judgment.

What constitutes a quorum?

At any meeting of stockholders, the holders of issued and outstanding shares of capital stock which represent a majority of the votes entitled to be cast thereat, present in person or represented by proxy, constitutes a quorum. A quorum is necessary in order to conduct the Annual Meeting. If you choose to have your shares represented by proxy at the Annual Meeting, you will be considered part of the quorum. Broker non-votes will be counted as present for the purpose of establishing a quorum. If a quorum is not present at the Annual Meeting, the stockholders present in person or by proxy may adjourn the meeting to a date when a quorum is present. If an adjournment is for more than 30 days or a new record date is fixed for the adjourned meeting, the Company will provide notice of the adjourned meeting to each stockholder of record entitled to vote at the meeting.

What vote is required to approve each matter, and how are votes counted?

Proposal 1 — Elect of directors — For Proposal 1, the nominees will be elected by a plurality of the votes of the shares present in person or represented by proxy at the Annual Meeting and entitled to vote. This means that the nominees with the most “FOR” votes will be elected. Abstentions and broker non-votes will each be counted as present for purposes of determining the presence of a quorum but will not have any effect on the outcome of the vote.

Proposal 2 — Ratify the selection of PricewaterhouseCoopers LLP as the Company’s independent registered public accounting firm — For Proposal 2, the affirmative vote of the majority of the votes properly cast on this proposal is required to ratify the selection of PricewaterhouseCoopers LLP as the Company’s independent registered public accounting firm for the Company’s fiscal year ending June 30, 2014. Abstentions will not be considered votes cast on the proposal and will therefore have no effect on such proposal.

Proposal 3 — Approval of an amendment to the Company’s Restated Certificate of Incorporation, as amended, to decrease the number of the authorized shares of the Company’s Common Stock to 70,000,000 –The proposal to approve the amendment to our Restated Certificate of Incorporation, as amended, requires the affirmative vote of the holders of a majority of the shares of the Company’s common stock issued and outstanding and entitled to vote.Both abstentions and broker non-votes will be counted as present for purposes of determining the presence of a quorum, and will have the same effect as votes “AGAINST” approval of each of these proposals.

Proposal 4 – Approval of the 2007 Omnibus Equity and Incentive Plan, as amended, which includes an increase in the share reserve by 3,000,000 shares, revisions to certain limitations on the awards intended to qualify as performance-based awards for purposes of Section 162(m) of the Internal Revenue Code of 1986, as amended, and the re-approval of performance goals for performance based awards – The proposal to approve the amended 2007 Omnibus Equity and Incentive Plan and the re-approval of performance goals for performance based awards requires the affirmative vote of a majority of the votes cast at the Annual Meeting, at which a quorum is present, either in person or by proxy. Abstentions and broker non-votes will not be considered votes cast on the proposal and will therefore have no effect on such proposal.

Proposal 5 — Approval, by a non-binding advisory vote, of the compensation of the Company’s named executive officers— The proposal to approve, on an advisory basis, the compensation of the Company’s named executive officers requires the affirmative vote of the votes properly cast on this proposal. Abstentions and broker non-votes will not be considered votes cast on the proposal and will therefore have no effect on such proposal. However, because your vote is advisory, it will not be binding upon the Company, the Board or the Compensation Committee.

Could other matters be presented for a vote at the Annual Meeting?

The Company is not aware, as of the date hereof, of any matters to be presented for a vote at the Annual Meeting other than those stated in this Proxy Statement. If any other matters are properly brought before the Annual Meeting, the persons named as proxy holders will have the discretionary authority to vote the shares represented by the proxy card on those matters. If for any reason any of the nominees are not available as a candidate for director, the persons named as proxy holders will vote your proxy for such other candidate or candidates as may be nominated by the Board

Where can you find the voting results?

We intend to announce the preliminary voting results at the Annual Meeting and will publish the final results in a Current Report on Form 8-K, which the Company will file with the SEC no later than four business days following the Annual Meeting. If the final voting results are unavailable in time to file a current report on Form 8-K with the SEC within four business days after the Annual Meeting, we intend to file a Form 8-K to disclose the preliminary results and, within four business days after the final results are known, we will file an additional current report on Form 8-K with the SEC to disclose the final voting results.

Who is soliciting proxies, how are they being solicited, and who pays the cost?

The solicitation of proxies is being made on behalf of the Board of Directors, and the Company will bear the costs of the solicitation. The Company will be responsible for paying for all expenses to prepare, print, and mail the proxy materials to stockholders. In accordance with the regulations of the SEC, the Company will make arrangements with brokerage houses and other custodians, nominees, and fiduciaries to send proxies and proxy materials to their principals and will reimburse them for their reasonable expenses in so doing. In addition to the solicitation by use of the mails, the Company officers, directors and employees may solicit the return of proxies by telephone or personal interviews. The Company may also retain a proxy solicitor if it appears reasonably likely that the Company may not obtain a quorum to conduct the Annual Meeting. The Company may retain a proxy solicitor, if it chooses to do so, not to exceed $7,500.

PROPOSAL 1

ELECTION OF DIRECTORS

The Company’s Restated Certificate of Incorporation, as amended, and the Company’s By-Laws provide that directors are to be elected at the Annual Meeting of Stockholders to hold office until the next annual meeting and until their respective successors are elected and qualified. Currently, the Board of Directors consists of seven members. Vacancies on the Board resulting from death, resignation, retirement, disqualification or removal may be filled by the affirmative vote of a majority of the remaining directors then in office, whether or not a quorum of the Board is present. Newly created directorships resulting from any increase in the number of directors may, unless the Board determines otherwise, be filled only by the affirmative vote of the directors then in office, whether or not a quorum of the Board is present. Any director elected as a result of a vacancy shall hold office for a term expiring at the next annual meeting of stockholders and until such director’s successor shall have been elected and qualified.

Based on the recommendation of the Nominating and Corporate Governance Committee, the Board of Directors has nominated Messrs. Cox, Dougherty, Fox, Hill, Plumb and Richard and Ms. VanLent to serve a one-year term commencing at the Annual Meeting and continuing until the 2014 annual meeting or until their successors are duly elected and qualified. Each of the nominees is an existing director of the Company.

Each of the nominees has consented to being named as a nominee for director of the Company and has agreed to serve if elected. If, for any reason, at the time of the election any of the nominees should become unavailable to serve as a director, it is intended that the proxies voted for the election of such director will be voted for the election, in such nominee’s place, of a substitute nominee recommended by the Board of Directors.

Set forth below is biographical information for each person nominated, including a description of the experience, qualifications, attributes and skills that led to the conclusion that the person should serve as a director of the Company as of the date hereof, in light of the Company’s business strategy, prospects and structure.

NOMINEES FOR ELECTION

Russell H. Plumb, age 54, has served as President, Chief Executive Officer and a director of the Company since November 2012. Mr. Plumb previously served as President, Chief Executive Officer and Chief Financial Officer of Inhibitex, Inc., a U.S. publicly-traded, clinical-stage drug development company, from December 30, 2006 through February 13, 2012, when it was acquired by Bristol-Myers Squibb. Prior to that, Mr. Plumb served as Vice President, Finance and Administration and Chief Financial Officer of Inhibitex from August 2000 through December 2006. From December 1999 to July 2000, Mr. Plumb served as Chief Financial Officer of Emory Vision, a privately-held healthcare company. From 1994 to November 1999, he served as Chief Financial Officer and Vice President, Finance of Serologicals Corporation, a publicly-held biopharmaceutical company. Mr. Plumb received both a Bachelor of Commerce and a M.B.A. from the University of Toronto. Mr. Plumb has received designations as a certified public accountant in Michigan and Georgia. Mr. Plumb’s experience in managing the strategic, financial and operational growth of emerging biopharmaceutical companies, as well as his key role in leading the Company and developing its current business strategy as Chief Executive Officer of the Company, led to the conclusion that he should serve on the Company’s Board of Directors.

James Fox, Ph.D., age 61, has served as Chairman of the Company’s Board of Directors since his appointment as a director in November 2012 and served as Chairman of the Board of Biota Holdings Limited from February 2009 to November 2012. Dr. Fox has extensive experience in global technology and healthcare businesses. Dr. Fox led the start-up of Invetech, an Australian contract research and development company that specializes in healthcare products and complex instruments for international markets. Invetech was merged with Australian Securities Exchange listed Vision Systems Limited in 1993 and Dr. Fox took over as Group Managing Director of the combined entity. In January 2007, Vision Systems Ltd., then a global cancer diagnostics company, was acquired by Danaher Corporation. Prior to Invetech, Dr. Fox spent seven years working as a consultant and director with PA Technology. Dr. Fox currently serves as a director of GenMark Diagnostics, Inc., Air New Zealand Ltd., TTP Group plc and MS Research Australia, a not-for-profit organization aimed at financing public multiple sclerosis research. Dr. Fox received his Bachelor’s, Master’s and Ph.D. degrees in engineering from the University of Melbourne. Dr. Fox’s extensive experience in the healthcare industry, including technology and product development, and his business leadership as a director of several companies led to the conclusion that he should serve on the Company’s Board of Directors.

Geoffrey F. Cox, Ph.D.,age 69, has served on the Company’s Board of Directors since 2000. Dr. Cox is an independent consultant and a senior advisor with Red Sky Partners LLC and a member of the board of directors of QLT Inc. He is also a member of the Board of Directors of Gallus Biopharmaceuticals LLC. Dr. Cox previously served as Chairman of the Board, President and Chief Executive Officer of GTC Biotherapeutics, Inc., a biopharmaceutical company, from 2001 to 2010. From 1997 to 2001, he was Chairman of the Board and Chief Executive Officer of Aronex Pharmaceuticals, Inc., a biotechnology company. From 1984 to 1997, he was employed by Genzyme Corporation, a biotechnology company, last serving as its Executive Vice President, Operations. Dr. Cox is Immediate Past Chairman of the Massachusetts Biotechnology Council and served for a number of years on the Board of the Biotechnology Industries Association (“BIO”), together with the Health Governing Sections and Emerging Companies Sections of BIO. Dr. Cox received a BS in biochemistry from the University of Birmingham, U.K., and a Ph.D. in biochemistry from the University of East Anglia, U.K. Dr. Cox’s extensive biotechnology industry expertise, including his many years of experience as an executive officer and board member of publicly-traded biotechnology companies, led to the conclusion that he should serve on the Company’s Board of Directors.

Michael R. Dougherty, age 55, has served as a member of our Board of Directors since May 2013. Mr. Dougherty was Chief Executive Officer, and a member of the Board of Directors, of Kalidex Pharmaceuticals, Inc. from May 2012 to October 2012. Mr. Dougherty was the President and Chief Executive Officer of Adolor Corp. and a member of the Board of Directors of Adolor from December 2006 until December 2011. Mr. Dougherty joined Adolor as Senior Vice President of Commercial Operations in November 2002, and until his appointment as President and Chief Executive Officer, served in a number of capacities, including Chief Operating Officer and Chief Financial Officer. From November 2000 to November 2002, Mr. Dougherty was President and Chief Operating Officer of Genomics Collaborative, Inc., a privately-held functional genomics company. Previously, Mr. Dougherty served in a variety of senior positions at Genaera Corporation, a publicly-traded biotechnology company, including as President and Chief Executive Officer and at Centocor, Inc., a publicly-traded biotechnology company, including as Senior Vice President and Chief Financial Officer. Mr. Dougherty received a B.S. from Villanova University. Mr. Dougherty’s deep understanding of biotechnology finance, research and development, sales and marketing, strategy, and operations and his executive experience as chief executive officer at several biotechnology companies led to the conclusion that he should serve on the Company’s Board of Directors.

Richard Hill, age 66, has served on the Company’s Board of Directors since November 2012 and he served as a director of Biota Holdings Limited from November 2008 to November 2012. Mr. Hill currently serves as chairman of the boards of directors of Sirtex Medical Limited, a biotechnology and medical device company listed on the ASX, Calliden Group Limited, an Australia-based company that underwrites general insurance and is listed on the ASX, and is Chairman of Blackwall Property Funds Limited, a vertically integrated property funds manager listed on the ASX. Mr. Hill was a founding partner of Hill Young & Associates, a corporate advisory firm, and previously held multiple senior executive positions in Hong Kong and New York with Wardley Holdings Limited, a wholly owned subsidiary of Hong Kong & Shanghai Banking Corporation (“HSBC”). Mr. Hill has been admitted as an attorney in New York, and holds a BA LLB (Sydney), and LLM (London). Mr. Hill’s business leadership as chairman and director of multiple companies and his extensive experience in finance and investing led to the conclusion that he should serve on the Company’s Board of Directors.

John P. Richard, age 56, has served as a member of our Board of Directors since August 2013. Since June 2005, Mr. Richard has been a managing director of Georgia Venture Partners, LLC, a venture capital firm that focuses on the biotechnology industry. Mr. Richard has served on the board of directors of Targacept, Inc. since November 2002. He has also served as senior business adviser to Agennix AG, a biotechnology company, since April 1999 and as a non-executive director of Phase4 Ventures Limited, a private equity fund, since March 2011. From 2008 until March 2011, Mr. Richard served as a venture partner of Nomura Phase4 Ventures LP. In addition, Mr. Richard currently serves and from time-to -time during at least the past five years has served as a consultant to portfolio companies of Georgia Venture Partners, as well as to Nomura Phase4 Ventures (or an affiliated entity) and certain of its portfolio companies. Within the past five years, Mr. Richard served as a member of the board of directors of the formerly publicly-traded company Altus Pharmaceuticals Inc. Mr. Richard’s extensive executive, venture capital and business development experience, having led that function at several life science companies and establishing numerous pharmaceutical alliances, led to the conclusion that he should serve on the Company’s Board of Directors.

Anne M. VanLent, age 65, has served as a member of our Board of Directors since May 2013. Ms. VanLent is President of AMV Advisors, providing corporate strategy and financial consulting services to emerging growth life sciences companies. Ms. VanLent also currently serves as a member of the board of directors and chair of the Audit Committee of Aegerion Pharmaceuticals, Inc., Ocera Pharmaceuticals, Inc., and Onconoda Therapeutics, Inc., all Nasdaq-listed companies. Ms. VanLent had been Executive Vice President and Chief Financial Officer of Barrier Therapeitics, Inc., a publicly traded pharmaceutical company that develops and markets prescription dermatology products, from May 2002 through April 2008. From July 1997 to October 2001, she was the Executive Vice President – Portfolio Management for Sarnoff Corporation, a multidisciplinary research and development firm. From 1985 to 1993, she served as Senior Vice President and Chief Financial Officer of the Liposome Company, Inc., a publicly-traded biopharmaceutical company. During the past five years, Ms. VanLent also served as a director of Penwest Pharmaceuticals Co., until its sale to Endo Pharmaceuticals in 2010, and as a director of Integra Life Sciences until May 2008, where she served as the Audit Committee from 2006 to 2012.. Ms. VanLent received a B.A. degree in Physics from Mount Holyoke College. Ms. VanLent’s extensive leadership and finance experience, and her extensive experience serving as a board member, audit committee member and audit committee chair of public companies in the life sciences industry led to the conclusion that he should serve on the Company’s Board of Directors.

Required Vote and Board Recommendation

If a quorum is present, the nominees will be elected by a plurality of the votes properly cast for election to the Board of Directors. This means that the nominees with the most “FOR” votes will be elected. Abstentions and broker non-votes will each be counted as present for purposes of determining the presence of a quorum but will not have any effect on the outcome of the vote.

The Board of Directors recommends a vote “For” each of the nominees for director.

CORPORATE GOVERNANCE

General

The Company’s By-laws provide that the number of members of the Board of Directors shall be determined from time-to-time by vote of a majority of directors then in office. The Board of Directors currently has seven members.

The Board of Directors has determined that Messrs. Dougherty, Hill and Richard, Ms. VanLent and Drs. Fox and Cox are independent under the standards of independence applicable to companies listed on the NASDAQ Global Select Market (“Nasdaq”). In addition, as required by Nasdaq, the Board of Directors has made an affirmative determination as to each independent director that no relationships exists which, in the opinion of the Board of Directors, would interfere with such director’s exercise of independent judgment in carrying out his responsibilities as a director of the Company.

During the fiscal year ended June 30, 2013, the Board of Directors met eleven times. Each member of the Board of Directors attended more than 75% of the aggregate number of meetings of the Board of Directors and of the committee or committees on which he or she served. The committees of the Board of Directors consist of an Audit Committee, a Compensation Committee and a Nominating and Corporate Governance Committee, each of which has the composition and responsibilities described below. The Board may also establish other committees from time-to-time to assist in the discharge of its responsibilities.

Committees of the Board of Directors

Audit Committee. The members of the Company’s Audit Committee are Ms. VanLent (Chair), Mr. Dougherty and Mr. Hill. The Board has determined that all members of the Audit Committee are independent directors under the Nasdaq listing standards and each of them is able to read and fundamentally understand financial statements. The Board has determined that Ms. VanLent qualifies as an “audit committee financial expert” as defined by the rules of the SEC. The purpose of the Audit Committee is to oversee both the accounting and financial reporting processes of the Company as well as audits of its financial statements. The responsibilities of the Audit Committee include appointing and approving the compensation of the independent registered public accounting firm selected to conduct the annual audit of the Company’s accounts, reviewing the scope and results of the independent audit, reviewing and evaluating internal accounting policies, and approving all professional services to be provided to the Company by its independent registered public accounting firm. The Audit Committee is governed by a written charter approved by the Board. The Audit Committee report is included in this Proxy Statement under the caption “Report of the Audit Committee.” The Company’s Audit Committee met six times during the fiscal year ended June 30, 2013.

Compensation Committee. The members of the Compensation Committee are Dr. Fox (Chair), Mr. Dougherty and Dr. Cox. The Board has determined that all members of the Compensation Committee are independent directors under the Nasdaq listing standards. The Compensation Committee administers the Company’s benefit and stock plans, reviews and administers all compensation arrangements for executive officers, and establishes and reviews general policies relating to the compensation and benefits of the Company’s officers and employees. The Compensation Committee meets several times a year to review, analyze and set compensation packages for the Company’s executive officers, which include its President and Chief Executive Officer and other senior officers. The Compensation Committee determines the Chief Executive Officer’s compensation and, as it deems appropriate, leverages industry benchmark compensation data. The Compensation Committee is solely responsible for determining the Chief Executive Officer’s compensation. For the other executive officers, the Chief Executive Officer prepares and presents to the Compensation Committee performance assessments and compensation recommendations. Following consideration of the Chief Executive Officer’s presentation, the Compensation Committee may accept or adjust the Chief Executive Officer’s recommendations. The other executive officers are not present during this process. For more information, please see below under “Compensation Discussion and Analysis.” The Compensation Committee is governed by a written charter approved by the Board. The Compensation Committee report is included in this proxy statement under the caption “Report of the Compensation Committee.” The Compensation Committee met six times during the fiscal year ended June 30, 2013.

Nominating and Corporate Governance Committee. The members of the Nominating and Corporate Governance Committee are Dr. Cox (Chair), Mr. Richard and Ms. VanLent, each of whom the Board has determined is an independent director under the Nasdaq listing standards. The Nominating and Corporate Governance Committee’s responsibilities include recommending to the Board nominees for possible election to the Board, ensuring that each of the committees of the Board have qualified and independent directors and providing oversight with respect to corporate governance and succession planning matters. The Nominating and Corporate Governance Committee is governed by a written charter approved by the Board. The Company’s Nominating and Corporate Governance Committee met three times during the fiscal year ended June 30, 2013.

The current charters of the Company’s Audit Committee, Compensation Committee and Nominating and Corporate Governance Committee are posted on Biota’s website at www.biotapharma.com .

Stockholder Recommendations for Director Nominees

In nominating candidates for election as director, the Nominating and Corporate Governance Committee will consider a reasonable number of candidates for director recommended by a single stockholder who has held over 0.1% of Common Stock for over one year and who satisfies the notice, information and consent provisions set forth in our by-laws and corporate governance guidelines. The Nominating and Corporate Governance Committee will consider stockholder recommendations for nominees sent to the Company’s Nominating and Corporate Governance Committee, Biota Pharmaceuticals, Inc., 2500 Northwinds Parkway, Suite 100, Alpharetta, Georgia 30009, Attention: Secretary. Any recommendation from a stockholder with respect to a nominee should include the name, background and qualifications of such candidate, and should be accompanied by evidence of such stockholder’s ownership of the Company’s Common Stock. The Nominating and Corporate Governance Committee will use the same evaluation process for director nominees recommended by stockholders as it uses for other director nominees.

Identification and Evaluation of Nominees for Directors

The Company’s Nominating and Governance Committee is responsible for identifying and recruiting candidates for the Board, including the review of a candidate’s qualifications and compliance with independence and any other legal requirements for Board or committee service. The Nominating and Governance Committee reviews with the Board from time-to-time the appropriate skills and characteristics required of Board members in the context of the make-up of the Board and developing criteria for identifying and evaluating candidates for the Board. These criteria include, among other things, an individual’s business experience and skills (including skills in core areas such as operations, management, technology, and drug development industry knowledge, accounting and finance, leadership, strategic planning and international markets), independence, judgment, integrity and ability to commit sufficient time and attention to the activities of the Board, as well as the absence of any potential or existing conflicts with the Company’s interests. The Nominating and Governance Committee considers these criteria in the context of an assessment of the perceived needs of the Board as a whole and seeks to achieve diversity of occupational and personal backgrounds on the Board.

Director Attendance at Annual Meetings of Stockholders

The Company encourages and expects each of its directors to attend the annual meeting of stockholders, absent unusual circumstances.

Board Leadership Structure

The Company is currently led by Mr. Plumb, the Company’s President and Chief Executive Officer, and James Fox, Ph.D., an independent director and the Chairman of the Board of Directors. Dr. Fox has served as the Chairman of the Board since November 2012 and has also served as Chairman of the Board of Biota Holdings Limited from February 2009 to November 2012. Pursuant to the Company’s Corporate Governance Guidelines, it is the Board’s preferred governance structure to separate the roles of Chairman of the Board and Chief Executive Officer, but the Board will regularly evaluate whether it is in the best interests of the Company for the Chief Executive Officer or another director to hold the position of Chairman.

The Board of Directors believes the Company’s current Board leadership structure is advantageous because it demonstrates to the Company’s stockholders, employees, suppliers, customers and other stakeholders that the Company is under strong leadership, with the Chairman maintaining an effective working relationship with other Board members and the Chief Executive Officer. Furthermore, the Board believes the separation of the roles of Chief Executive Officer and Chairman enhances the Board’s oversight of, and independence from, Company management, the ability of the Board to carry out its roles and responsibilities on behalf of the Company’s stockholders, and the Company’s overall corporate governance.

Stockholder Communications

Communications to the Board or to any committee of the Board or to any individual director must be in writing and sent correspondence to Biota Pharmaceuticals, Inc., 2500 Northwinds Parkway, Suite 100, Alpharetta, Georgia 30009, Attention: Corporate Secretary or delivered via e-mail to pazzarello@biotapharma.com. The name(s) of any specific intended Board recipient(s) should be noted in the communication.Any such communication should specify the applicable director(s) to be contacted, as well as the general topic of the communication. The Company will initially receive and process a communication before forwarding it to the applicable director(s). The Company generally will not forward a stockholder communication to its directors if it determines that such communication is primarily commercial in nature or is abusive, threatening or otherwise inappropriate.

Corporate Governance Guidelines

The Company’s corporate governance guidelines are designed to ensure effective corporate governance of the Company. These corporate governance guidelines cover topics including, but not limited to, director qualification criteria, director compensation, director orientation and continuing education, communications from stockholders to the Board, succession planning and the annual evaluations of the Board and its committees. Corporate governance guidelines will be reviewed regularly by the Nominating and Corporate Governance Committee and revised when appropriate. The full text of the Company’s corporate governance guidelines is accessible to the public at www.biotapharma.com. A printed copy may also be obtained by any stockholder upon request.

Code of Ethics

The Company’s Board adopted a code of ethics to ensure that our business is conducted in a consistently legal and ethical manner. The code of ethics establishes policies pertaining to, among other things, employee conduct in the workplace, securities trading, confidentiality, conflicts of interest, reporting violations and compliance procedures. All employees, including the Company’s executive officers, as well as members of its Board, are required to comply with this code of ethics. The full text of code of ethics is accessible to the public at www.biotapharma.com. A printed copy may also be obtained by any stockholder upon request. Any waiver of the code of ethics for executive officers or directors must be approved by the Board after receiving a recommendation from the Audit Committee. The Company will disclose future waivers and amendments to its code of ethics on its website, www.biotapharma.com, within four business days following the date of the amendment or waiver.

Role of Board in Risk Oversight Process

The responsibility for the day-to-day management of risk lies with the Company’s management, while the Board is responsible for overseeing the risk management process to ensure that it is properly designed, well-functioning and consistent with the Company’s overall corporate strategy. Each year the Company’s management identifies what it believes are the top individual risks facing the Company. These risks are then discussed and analyzed with the Board. This enables the Board to coordinate the risk oversight role, particularly with respect to risk interrelationships. However, in addition to the Board, the committees of the Board consider the risks within their areas of responsibility. The Audit Committee oversees the risks associated with the Company’s financial reporting and internal controls, the Compensation Committee oversees the risks associated with the Company’s compensation practices, including an annual review of the Company’s risk assessment of its compensation policies and practices for its employees, and the Nominating and Corporate Governance Committee oversees the risks associated with the Company’s overall governance, corporate compliance policies (for example, policies addressing relationships with health care professionals and compliance with anti-kickback laws) and its succession planning process to understand that the Company has a slate of future, qualified candidates for key management positions.

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Exchange Act requires the directors, executive officers and persons who beneficially own more than 10% of the Common Stock (collectively the “Reporting Persons”) to file reports of ownership and changes in ownership of Common Stock with the SEC, with a copy delivered to the Company. In addition, the Company prepares Section 16(a) reports on behalf of certain Reporting Persons, including its officers and directors. Based solely on a review of Forms 3 and 4 furnished to the Company by the Reporting Persons or prepared on behalf of the Reporting Persons by the Company and on written representations from certain Reporting Persons that no Forms 5 were required, the Company believes that the Reporting Persons have complied on a timely basis with reporting requirements applicable to them for transactions during the fiscal year ended June 30, 2013.

Compensation Committee Interlocks and Insider Participation

No member of the Company’s Compensation Committee was an officer or employee of the Company. In addition, none of the Company’s executive officers has served on the board of directors or Compensation Committee of another entity at any time during which an executive officer of such other company served on the Company’s Board of Directors or its Compensation Committee.

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS

Review and Approval of Related Person Transactions

The Company’s Related Party Transaction Policy and Procedures requires all directors and executive officers of the Company to bring any potential transaction, arrangement or relationship or series of similar transactions, arrangements or relationships (including any indebtedness or guarantee of indebtedness) involving a “related person” (as such term is defined in Item 404 of Regulation S-K) to the attention of the Audit Committee. Under the policy, the Audit Committee is responsible for reviewing and either approving or disapproving transactions involving potential conflicts of interest with corporate officers and directors, whenever possible in advance of the creation of such transaction or conflict and all other related party transactions. In determining whether to approve or ratify such a transaction, the Audit Committee will take into account, among other factors it deems appropriate, the material terms of the transaction, the nature of the related party’s interest in the transaction, the significance of the transaction to the related party and the nature of the related party’s relationship with the Company, the significance of the transaction to the Company, and whether the transaction would be likely to impair (or create an appearance of impairing) the judgment of a director or executive officer to act in the best interest of the Company.

Related Person Transactions

The Company is not aware of any transactions, since the beginning of the last fiscal year, or any proposed transactions, in which the Company was or is a party, where the amount involved exceeded $120,000 and in which a director, director nominee, executive officer, holder of more than 5% of the Company’ Common Stock, or any member of the immediate family of any of the foregoing persons, had or will have a direct or indirect material interest.

PRINCIPAL STOCKHOLDERS

The following table sets forth certain information known to the Company with respect to the beneficial ownership of its Common Stock as of August 31, 2013 (except as indicated in the footnotes below), by:

|

|

|

|

|

|

|

|

The column entitled “Percentage of Shares of Common Stock Beneficially Owned” is based on 28,423,987 shares of Common Stock outstanding as of August 31, 2013, assuming no further exercises of outstanding options or warrants. Ownership is based upon information provided by each respective officer and director, Forms 4, Schedules 13G and other public documents filed with the SEC for some of the stockholders.

Beneficial ownership is determined in accordance with the rules of the SEC. The information does not necessarily indicate beneficial ownership for any other purpose. For purposes of calculating each person’s or group’s percentage ownership, except as set forth in the footnotes to the beneficial ownership table below, stock options exercisable or equity awards that will vest within 60 days after August 31, 2013 are included for that person or group, but not such awards of any other person or group.

Except as otherwise noted, the persons or entities in this table have sole voting and investing power with respect to all of the shares of Common Stock beneficially owned by them, subject to community property laws, where applicable.

Beneficially Owned | Shares Held | Percentage of Shares of Common Stock Beneficially Owned (%) | ||||||

5% stockholders: | ||||||||

Entities affiliated with London T. Clay(1) | 3,164,017 | 11.1 | ||||||

Entities affiliated with Hunter Hall Investment Management Ltd(2) | 2,080,839 | 7.3 | ||||||

Named executive officers and directors: | ||||||||

Russell H. Plumb | 47,774 | * | ||||||

Joseph M. Patti, M.S.P.H., Ph.D. | 23,887 | * | ||||||

James Fox, Ph.D. (3) | 43,664 | * | ||||||

Geoffrey Cox, Ph.D. (4) | 45,110 | * | ||||||

Michael Dougherty | — | * | ||||||

Richard Hill (5) | 14,300 | * | ||||||

John Richard | — | * | ||||||

Anne VanLent | — | * | ||||||

Raafat Fahim, Ph.D. (6) | 143,431 | * | ||||||

Paul Kessler, M.D. (7) | 37,166 | * | ||||||

Matthew Kalnik, Ph.D. (8) | 85,267 | * | ||||||

All current executive officers and directors as a group (8 persons) (9) | 174,735 | * | ||||||

|

|

(1) The foregoing information is based solely upon information contained in a Schedule 13G/A filed with the SEC on February 13, 2013 by London T. Clay and certain affiliates. East Hill Hedge Fund, LLC (“EHHF”) beneficially owns 1,515,629 shares of Common Stock of the Company. Landon T. Clay is the managing member of East Hill Holding Company, LLC (“EHHC”), which is the managing member of each of East Hill Management Company, LLC (“EHM”) and East Hill Advisors, LLC (“EHA”). EHM is registered as an investment adviser with the Securities and Exchange Commission. EHM has eight (8) investment advisory clients, including EHHF. EHA is the general partner of various venture capital limited partnerships which own shares of the Company. These venture capital limited partnerships are East Hill University Spinouts Fund I, LP, East Hill University Spinouts Fund II, LP, East Hill University Spinouts Fund III, LP, East Hill University Spinouts Fund IV, LP, East Hill University Spinouts Fund V, LP, East Hill University Spinouts Fund VI, LP, East Hill University Spinouts Fund V(b), LP, and East Hill Venture Fund, LP, each a Delaware limited partnership (collectively, the “Funds”). As a result of such relationships, Landon T. Clay may be deemed to beneficially own an aggregate of 3,191,505 shares of Common Stock. This total includes (i) 27,488 shares held directly by Mr. Clay, (ii) an aggregate of 280,594 shares of Common Stock held by the Funds, (iii) and aggregate of 2,783,892 shares held by the Clients of which EHHF holds 1,515,629 shares, and (iv) 99,531 shares held by EHM. Landon T. Clay disclaims beneficial ownership of the shares of Common Stock.

(2) The foregoing information is based solely upon information contained in a Schedule 13G/A filed with the SEC on July 26, 2013 by Hunter Hall Investment Management Ltd. (“HHIM”) and certain affiliates, located at Level 2, 60 Castlereagh Street, Sydney NSW 2000 Australia. HHIM is a wholly owned subsidiary of Hunter Hall International Ltd (“HHI”). Hampshire Assets and Services Pty Ltd (“Hampshire”) owns 43.81% of HHI. Peter Hall owns 100% of Hampshire and controls a further 1.31% of HHI through other holdings. As a result of such relationships, Peter Hall may be deemed to beneficially own an aggregate of 3,267,905 shares of common stock. HHIM has the power to control the exercise of the right to vote attached to the shares, and the power to exercise control over the disposal of shares as Responsible Entity of the (i) 1,635,592 shares held by Hunter Hall Value Growth Trust and (ii) the 445,247 shares held by Hunter Hall Global Value Limited.

(3) Includes 4,350 shares of Common Stock underlying restricted stock units which will vest within 60 days of August 31, 2013. Includes 30,614 shares held by Penashe Holdings Propriety Limited. Dr. Fox is an executive director of Penashe Holdings Proprietary Limited and may be deemed to have beneficial ownership of these securities, to the extent of any indirect pecuniary interest in his distributive shares therein

(4) Includes 40,830 options to purchase shares of Common Stock currently exercisable or exercisable within 60 days of August 31, 2013 and 4,280 shares of common stock.

(5) Includes 4,350 shares of Common Stock underlying restricted stock units which will vest within 60 days of August 31, 2013 and 9,950 shares of common stock.

(6) Includes 143,431 options to purchase shares of Common Stock currently exercisable or exercisable within 60 days of August 31, 2013.

(7) Includes 37,166 options to purchase shares of Common Stock currently exercisable or exercisable within 60 days of August 31, 2013.

(8) Includes 85,267 options to purchase shares of Common Stock currently exercisable or exercisable within 60 days of August 31, 2013.

(9) Includes 125,205 shares of Common Stock underlying outstanding options or restricted stock units as of August 31, 2013, 40,830 options to purchase shares of Common Stock currently exercisable or exercisable within 60 days of August 31, 2013 and 8,700 shares of Common Stock underlying restricted stock units which will vest within 60 days of August 31, 2013.

EXECUTIVE OFFICERS

The following table sets forth information concerning the current executive officers of the Company:

|

|

| |||||||

|

|

| |||||||

|

|

| |||||||